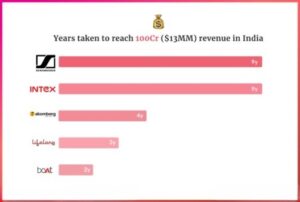

Founded in 2016 by Aman Gupta and Sameer Mehta , boAt Lifestyle is an Indian startup specializing in affordable audio technology. With a primary focus on wireless speakers, earbuds, smartwatches, headsets, and earphones, boAt has rapidly gained popularity for its stylish technology offerings. Vivek Gambhir currently leads the company as the CEO.boAt embarked on its journey with a modest capital of INR 30 lacs, invested by its founders. Despite humble beginnings, the company has demonstrated remarkable growth and resilience in the competitive consumer electronics market.

boAt has positioned itself as a brand that integrates stylish technology into everyday lives, offering a diverse range of audio products. The company is committed to providing affordable yet high-quality devices. This strategy has resonated particularly well with its target audience, primarily young people who seek value for money without compromising on quality.

In the financial year 2022-23, BoAt Lifestyle, an Indian audio and wearable consumer electronics brand, experienced remarkable growth in its revenue, reaching Rs 4,000 crore in net sales. This substantial increase reflects the brand’s strong presence in the ever-evolving audio segment and its recognition as the world’s 5th largest wearable brand and India’s 1st, owing to a high market share.

Financial Performance:

Revenue Growth:

BoAt’s revenue in FY 22-23 witnessed a phenomenal 2X increase, soaring from approximately Rs 2,000 crore in the previous fiscal year (FY 21-22) to an impressive Rs 4,000 crore. This surge in revenue can be attributed to the surging demand for its audio devices and the brand’s success in maintaining a high customer retention rate.

Operating Revenue:

The operating revenue also witnessed a substantial increase, reaching Rs 2,873 crore in FY 22-23 compared to Rs 1,314 crore in FY 21-22, marking a 2.2 times growth. These financial indicators showcase BoAt’s strong market position and the effectiveness of its business strategies.

Net Profit Decline

However, despite the significant revenue growth, BoAt faced a challenge in the form of a 20% decline in net profit. This decline was primarily attributed to the high procurement costs, which outpaced the growth in revenue during the same period.

Revenue Breakdown:

Segment-wise Analysis

FY 22-23:

| Segment | Revenue (in Crores) |

|---|---|

| Audio Devices | Rs 2,276 |

| Wearable Items | Rs 515.5 |

| Other Operations | Rs 81.5 |

| Total Operating Revenue | Rs 2,873 |

BoAt derived the largest portion of its revenue from the sale of audio devices, followed by revenue from the sale of wearable items and other operations.

FY 21-22 (Comparison):

| Segment | Revenue (in Crores) |

|---|---|

| Audio Devices | Rs 1,228.6 |

| Wearable Items | Rs 54.8 |

| Other Operations | Rs 30.6 |

| Total Operating Revenue | Rs 1,314 |

Comparing FY 21-22 with FY 22-23, it is evident that BoAt experienced substantial growth across all segments, with a total operating revenue increase of 118.6%.

Expenses and Net Profit:

FY 21-22 vs FY 22-23:

| Metric | FY 21-22 (in Crores) | FY 22-23 (in Crores) | Growth (%) |

|---|---|---|---|

| Total Expenses | Rs 1,228.6 | Rs 2,873 | 132% |

| Net Profit | Declined by 20% |

The total expenses for BoAt increased by 132%, primarily driven by the significant growth in revenue. However, despite the surge in revenue, the net profit declined by 20%, indicating challenges in cost management.

Market Position and Projections:

As of 2022, boAt boasts over 2 million users, achieving a remarkable daily sales volume of 14,000 to 15,000 products. The company’s success lies in its ability to create a broad and appealing selection of headphones, wireless speakers, earbuds, and Airpods. The target population finds boAt approachable, thanks to its competitive pricing and commitment to product quality.

Imagine Marketing Limited, the parent company of the renowned audio and wearable consumer electronics brand boAt, has taken a significant step towards becoming a publicly traded company. The company filed a Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on January 26, 2022, outlining its plans for an Initial Public Offering (IPO) to raise Rs. 2,000 crores. This move signifies a crucial milestone in Imagine Marketing Limited’s journey and reflects its ambition for further growth and market expansion.

IPO Details:

Fundraising Objective

The IPO of Imagine Marketing Limited aims to raise a total of Rs. 2,000 crores. This includes a fresh issue of equity shares amounting to Rs. 900 crores and an offer for sale worth Rs. 1,100 crores. The fresh issue of equity shares represents the infusion of new capital into the company, while the offer for sale involves existing shareholders selling their stakes.

Fresh Issue of Equity Shares:

The company intends to raise Rs. 900 crores through the issuance of fresh equity shares. This capital infusion will likely be utilized for various purposes such as:

- Expansion Plans: Funding for new product development, research and development initiatives, and market expansion.

- Working Capital: Allocation of funds to strengthen the company’s working capital position and operational efficiency.

- Debt Repayment: Repayment of existing debts to enhance the financial health of the company.

Offer for Sale:

Imagine Marketing Limited plans to generate Rs. 1,100 crores through the offer for sale, wherein existing shareholders will sell a portion of their holdings. This portion of the IPO provides an exit opportunity for early investors or existing shareholders looking to liquidate some of their investments.

Pre-IPO Placement:

In addition to the IPO, the company aims to raise Rs. 180 crores through a pre-IPO placement. This involves selling shares to institutional investors or other qualified buyers before the IPO is launched. Pre-IPO placement helps in gauging investor interest and securing commitments ahead of the public offering.

Utilization of Funds:

The funds raised through the IPO will be strategically utilized to drive the company’s growth initiatives. While the specific allocation may be outlined in the final prospectus post SEBI’s approval, potential use of funds may include:

- Research and Development: Investment in innovative technologies, product enhancements, and staying ahead in the competitive consumer electronics market.

- Marketing and Branding: Strengthening the brand image, expanding marketing efforts, and increasing brand visibility globally.

- Manufacturing Facilities: Expanding or upgrading manufacturing facilities to meet growing demand and improve production efficiency.

- Distribution Network: Enhancing the distribution network to reach a wider customer base, both nationally and internationally.

- Working Capital Requirements: Ensuring ample liquidity for day-to-day operations and managing fluctuations in demand.

SEBI Approval and IPO Launch:

As of now, Imagine Marketing Limited is awaiting SEBI’s approval for its IPO. Once the regulatory body grants approval, the company can move forward with launching the IPO in the market. The IPO process will involve various steps, including roadshows, book building, and determining the final issue price. The IPO launch will mark a significant event in the company’s history and provide an opportunity for investors to participate in the growth story of Imagine Marketing Limited.

Funding :

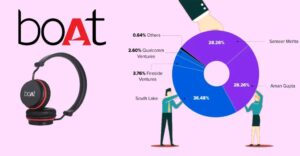

Boat Lifestyle has raised a total funding of $171M over 9 rounds.

| Date | Funding Amount | Round Name | Post Money Valuation | Revenue Multiple | Investors |

|---|---|---|---|---|---|

| Oct 28, 2022 | $60.7M | Series C | $191M | – | Warburg Pincus, Malabar Investments |

| Jan 13, 2022 | $271K | Series B | – | – | Innoven Capital |

| Apr 15, 2021 | $6.65M | Series B | $256M | 1.0x | Qualcomm Ventures |

| Dec 26, 2020 | $100M | Series B | – | – | South Lake Investment, Warburg Pincus, Qualcomm Ventures |

| Sep 01, 2020 | $3.41M | Venture Debt | – | – | Innoven Capital |

| Jul 26, 2019 | $2.32M | Venture Debt | – | – | Innoven Capital |

| Jul 17, 2019 | $2.92M | Venture Debt | – | – | Navi |

| Jan 08, 2019 | $2.16M | Seed | $67.6M | 2.0x | Fireside Ventures |

| Apr 06, 2018 | $922K | Seed | $14.6M | 1.0x | Fireside Ventures |

Acquisitions:

1.KaHa (Year of Acquisition: 2022):

- Details: boAt expanded its business portfolio by acquiring KaHa, a technology company specializing in wearable platforms. This strategic move allows boAt to strengthen its presence in the wearable tech market and enhance its product offerings.

- Purpose: The acquisition of KaHa aligns with boAt’s vision of becoming a comprehensive player in the consumer electronics space, particularly in the growing market of smart wearables.

2.Tagg (Year of Acquisition: 2021):

- Details: boAt made a significant acquisition by bringing Tagg, a brand known for its audio and smart wearables, into its fold. This acquisition allowed boAt to diversify its product range and tap into Tagg’s expertise in the wearable technology segment.

- Purpose: The acquisition of Tagg complements boAt’s strategy of expanding its footprint in the wearables market, capitalizing on the increasing demand for smart accessories.

These acquisitions represent boAt’s strategic efforts to broaden its product offerings, enhance technological capabilities, and establish a more comprehensive presence in the consumer electronics sector. The company aims to leverage the strengths and expertise of the acquired brands to drive innovation and meet the evolving demands of its customer base.

Latest Shareholding Summary:

1. Legal Entity: IMAGINE MARKETING PRIVATE LIMITED

2. Valuation: Rs. 10,800 Crores

3. Founders’ Net Worth: Rs. 5,760 Crores

4. Founders’ Holding: 53.52%

Growth Strategy:

Boat Lifestyle’s growth strategy is a comprehensive plan aimed at expanding its market presence, increasing revenue, and solidifying its position as a leading player in the consumer electronics industry. The company’s success is attributed to a combination of factors, including product diversification, market expansion, strategic partnerships, and a focus on customer engagement.

- Product Diversification:

- Boat has successfully diversified its product portfolio to cover a wide range of audio and lifestyle electronics, including wireless speakers, earbuds, smartwatches, headsets, and more.

- Continuous innovation in product design, features, and technology ensures that Boat caters to various consumer preferences and stays ahead of market trends.

- Market Expansion:

- Boat has strategically expanded its market reach, targeting not only the domestic market in India but also international markets.

- The brand’s focus on affordability and value for money appeals to a broad demographic, allowing it to tap into different consumer segments.

- Strategic Partnerships:

- Collaborations with celebrities and influencers have been a crucial aspect of Boat’s marketing strategy. These partnerships help enhance brand visibility and create a strong connection with the target audience.

- Strategic alliances with e-commerce platforms and retail outlets contribute to increased product availability and accessibility.

- E-commerce Focus:

- Boat has embraced the shift in consumer preferences towards online shopping by establishing a robust e-commerce presence.

- Leveraging online platforms enables the company to directly engage with consumers, efficiently manage inventory, and adapt to the evolving dynamics of the digital retail landscape.

- Brand Image and Positioning:

- Boat has carefully cultivated a youthful and trendy brand image, positioning itself as a lifestyle and fashion-oriented electronics brand.

- The emphasis on bright and distinctive product designs helps the brand stand out in a competitive market, appealing to the preferences of its target demographic.

- Customer Engagement:

- Active engagement through social media platforms allows Boat to directly interact with its customers, build a community around the brand, and gather feedback for continuous improvement.

- The brand’s online presence contributes to a dynamic and engaged customer base, fostering brand loyalty.

- Financial Strategies:

- Boat’s pricing strategy, offering high-quality audio devices at reasonable costs, has been a key success factor. This approach makes the brand accessible to a wider audience, particularly the younger demographic.

- The company’s financial discipline and management strategies contribute to its sustained growth and financial health.

- International Recognition:

- Boat’s recognition as the world’s 5th largest wearable brand and India’s 1st in 2022 underscores its global footprint and success in the international market.

Boat Lifestyle’s growth strategy is multifaceted, incorporating product innovation, market expansion, strategic collaborations, and a keen focus on customer satisfaction. The brand’s ability to adapt to market trends and connect with its target audience has been instrumental in its remarkable success in the consumer electronics industry.

For more such articles visit NationToday