Meesho, an e-commerce platform located in Bangalore, India, has emerged as a giant in the e- commerce industry since its origin in 2015. The founders are Vidit Aatrey and Sanjeev Barnwal, both graduates of IIT Delhi, Meesho at starting faced challenges with its on-demand delivery service model. However, a strategic turn around in 2016 transformed the platform into a social commerce superpower, connecting suppliers, resellers, and customers through external social media sites such as Facebook and Instagram.

The parent company of Meesho, Fashnear Technologies Private Limited, was founded in July 2015 as an on-demand delivery service for fashion products from local shops. Inspite seeing initial setbacks, the founders recognized the ignite of a reseller-based model leveraging social media for marketing. This pivotal shift laid the foundation for Meesho’s triumph.

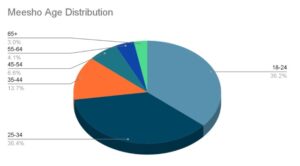

Untill February 2019, Meesho had 1.2 million orders per month and 209,000 users, marking a significant increase to 563,000 users and 3.1 million orders per month by March 2020. The stage viewed rapid growth in 2021 and 2022, and monthly transacting users soaring 26 times. In 2022, Meesho boasted around 120 million monthly users, facilitating approximately 910 million orders.

Financial Performance:

Meesho’s financial glory is evident from its revenue of ₹5,735 crores (US$720 million) in the fiscal year 2022-23, with a net income of ₹-1,675 crores (US$-210 million). The company showcased a remarkable 77% year-on-year growth, reaching a milestone of 500 million app downloads in FY24. Meesho secured funding from famous investors, including Fidelity, Prosus, B Capital Group, Softbank,Sequoia India, and Meta(Facebook).

- Revenue and Net Income (FY23):

- Meesho showed a robust financial performance in the fiscal year 2022-23 with a whooping revenue of ₹5,735 crores (US$720 million).

- Inspite the impressive revenue, the company reported a net gain of ₹-1,675 crores (US$-210 million), showing a loss for the fiscal year.

- Operating Scale and Growth (FY23):

- Meesho experienced a crucial year-on-year growth of 77%, with its operating scale reaching ₹5,735 crores in FY23 from ₹3,240 crores in fiscal year FY22.

- The platform demonstrated its ability to scale efficiently, handling 14.5 crore app downloads in 2023 in India and surpassing 500 million downloads in H1 FY24.

- Profitability Measures (H1 FY24):

- Meesho claimed to get profitability with positive cash flow in India from July 2023.

- The company’s effective cost mechanism contributed to a 48% reduction in losses, bringing them down to ₹1,675 crores in FY23 from ₹3,248 crores in fiscal yearFY22.

- Revenue and Losses (H1 FY24):

- H1 FY24 results showed a 37% YoY increase in revenue, reaching ₹3,521 crores.

- The losses were significantly lowered by 90% YoY, amounting to ₹141 crores in the same interval.

| Financial Metrics | Amount (FY23) |

|---|---|

| Revenue | ₹5,735 crores (US$720 million) |

| Net Income | ₹-1,675 crores (US$-210 million) |

Funding :

In 2021, Meesho declared a total funding of approx. US$1.1 billion, maintaining a cash flow of US$400 million. The company’s growth is further proved by its Gross Merchandise Value (GMV), which increased ninefold in two years, touching around $5 billion in 2022.

| Funding Rounds | Amount Raised | Investors |

|---|---|---|

| Series A (Oct 2017) | US$3.4 million | Multiple Investors |

| Series B (Jun 2018) | US$11.5 million | Multiple Investors |

| Series C (Nov 2018) | US$50 million | Multiple Investors |

| Series D (Jun 2019) | US$25 million | Meta Platforms (Facebook) |

| Series F (Sep 2021) | US$570 million | Fidelity Management & Research Company, B Capital Group |

Growth Strategy of Meesho:

- User Acquisition and Retention:

- Meesho’s growth strategy includes growing its user base, proven from its rapid growth in monthly transacting users. Meesho prioritizes customer retention through effective marketing on external social media platforms.

- Strategic Pivots:

- Meesho’s ability to pivot significantly, transitioning from an on-demand delivery service to a reseller-based model, showcases adaptability and a keen understanding of market dynamics.

- Product Diversification:

- The idea of Meesho Mall demonstrates a commitment to product diversification, offering users a best shopping experience and potentially increasing the average transaction value.

- Supplier Expansion:

- Meesho’s onboarding of more than 25,000 non-GST sellers indicates a focus on expanding its supplier base, ensuring a diversification and extensive product catalog.

- Technology and Innovation:

- Meesho continues to prioritize technology and innovation, With Sanjeev Barnwal as the CTO,leveraging these aspects to enhance user experience, optimize operational efficiency, and stay ahead in the competitive e-commerce landscape.

- Financial Optimization:

- Meesho’s focus on cost control, as evidenced by the reduction in losses and efficient management of customer acquisition costs and infrastructure cost, reflects a clear approach to financial optimization.

Ownership:

- Founder and CEO:

- Vidit Aatrey (IIT Delhi graduate), leading the company’s strategic vision and overall operations, as the CEO of Meesho.

- CTO:

- Sanjeev Barnwal ( IIT Delhi graduate) as a co-founder, holds the position of Chief Technology Officer (CTO), responsible for seeing the technological areas of the platform.

- Ownership Structure:

- Meesho is owned by Fashnear Technologies Private Limited, the Indian company established by the above founders.

- Investors:

- Meesho has raised support from various investment firms, including Fidelity, Softbank, Prosus, B Capital Group, Sequoia India, and Meta.

- Funding Rounds:

- The company has undergone numerous funding rounds, starting from Series A in October 2017, with subsequent rounds attracting substantial investments, demonstrating confidence from investors in Meesho’s potential.

Meesho’s story from a failed on-demand delivery service to one of India’s fastest-growing e-commerce platforms is a testament to its strategic pivots, resilience and innovative business model. The platform’s triumph is not only reflected in its financial numbers but also in its commitment to customer satisfaction, onboarding non-GST sellers, and the launch of Meesho Mall. As Meesho continues to prioritize profitability, its evolution from a startup to a unicorn in 2022 shows the power of adaptability and strategic planning in the dynamic e-commerce sector in India.

For more such articles visit NationToday